It may seem simple enough to divide employees’ salaries by 26 each year and pay 26 equal payments until the end of the year, but because that only equals 260, and there are actually 261 workdays (M-F) most years, after a number of years the schedule falls farther and farther behind until 12 years down-the-road you are paying next year’s first paycheck 2 weeks before next year even starts! This happens because the real calendar is adding a day each year (261) – and you are not keeping up (260). This chart dramatizes the slippage over 12 years: 12 years of ignoring the problem

Over a two hundred year span there are 260 days 25% of the time, 261 – 62% of the time, and 262 – 13%. Click here to see the chart: Workdays Per Year

(If you already understand this issue and you are on this page to fetch the spreadsheet for calculating annual salaries – here it is: Dale’s Salary Calculation spreadsheets for 261 days etc – everyone else read on.)

A quick note on why we do 261 days versus 365:

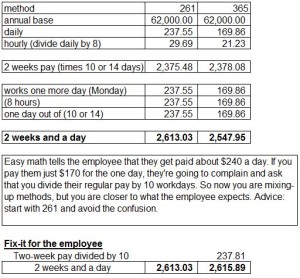

Monday through Friday employees expect to get paid for the days they work, they never think of weekend days as part of the calculation. They expect to get paid what they perceive to be their daily rate. In the chart below you can see that the 2-week pay is close using either method, but when the employee works one more day before leaving (Monday), if you stick with your chosen method, the employee might not be happy if your method is 365 – they end up short of what their head math tells them:

So for M-F employees you might want to stick to the 261 method. But, for elected officials – they think more along the lines of the 365 method, and are generally expecting your calculation to be based on 365 (or 366), so for them use the “Elected” tab on this spreadsheet.

Back to the 260 versus 261 issue:

Beyond the basic issue of getting ahead of your budget, there are other issues with getting behind with the payroll schedule.

First – there is no legal provision for paying wages before work is performed. The only one I know of is the one that allows for the prepayment of vacation pay – but that requires acceptance of the section at town meeting. (see MGL 44 §65) I imagine auditors would have a problem with it as well.

Second – there is no legal provision for paying expenses before the fiscal year begins. I remember there was a provision for schools to purchase supplies in advance of July 1st if it was going to save money and because they needed to get ready for the school year, but I am sure it doesn’t include wages.

Solutions good and bad:

Paying a 27th pay every 12 years – what some do to correct the situation – is not a real solution because it:

- Causes budgeting woes – towns have to increase the budget just this one year an extra 3.84%

- Is a misallocation of funds (because it is essentially paying an extra day for each of the prior 12 years).

- Just starts the cycle all over again, and has to be done again in 12 years

Skipping a payroll is not a real solution either because it:

- Leaves the employee without regular funds for 4 weeks

- To a new employee this feels like they are paying for someone else’s mistake.

- Doesn’t fix the problem – it just starts the cycle over again.

The correct solution is to find the daily rate (or hourly) and multiply it by the number of workdays* in the fiscal year and budget that amount. Then pay by the day. Of course the regular two-week pay periods will be the same throughout the year (10 days), but the first pay in July will be part from the end of June, and part from the beginning of July. (Example: pay check dated Thursday, July 14, 2011 would include 4 days in June at last years daily rate of $80, and 6 days at the new year’s rate of $82, for a total of $812.)

*Over a two hundred year span there are 260 days 25% of the time, 261 – 62% of the time, and 262 – 13%. Click here to see the chart: Workdays Per Year